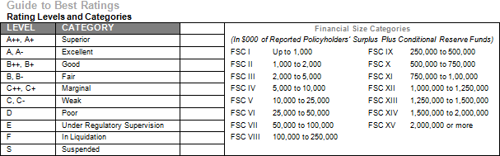

| Carriers | A.M. Best Rating | Admitted/Non-Admitted |

|---|---|---|

|

Continental Insurance Company of New Jersey |

"A", Financial Size: XV | Admitted |

Note: Any entity not named in this proposal, may not be an insured entity. This may include partnerships and joint ventures.

This proposal of insurance features insurance policies which contain cancellation provisions and/or cancellation penalties/fees which refund premium other than on a pro-rata basis. The insurance carrier's assessment of such cancellation fees are detailed in this proposal for any line of coverage where the proposed insurer is applying such fees.

The above A.M. Best Rating was verified on the date the proposal document was created.

Best's Insurance Reports , published annually by A.M. Best Company, Inc., presents comprehensive reports on the financial position, history, and transactions of insurance companies operating in the United States and Canada. Companies licensed to do business in the United States are assigned a Best’s Rating which attempts to measure the comparative position of the company or association against industry averages.

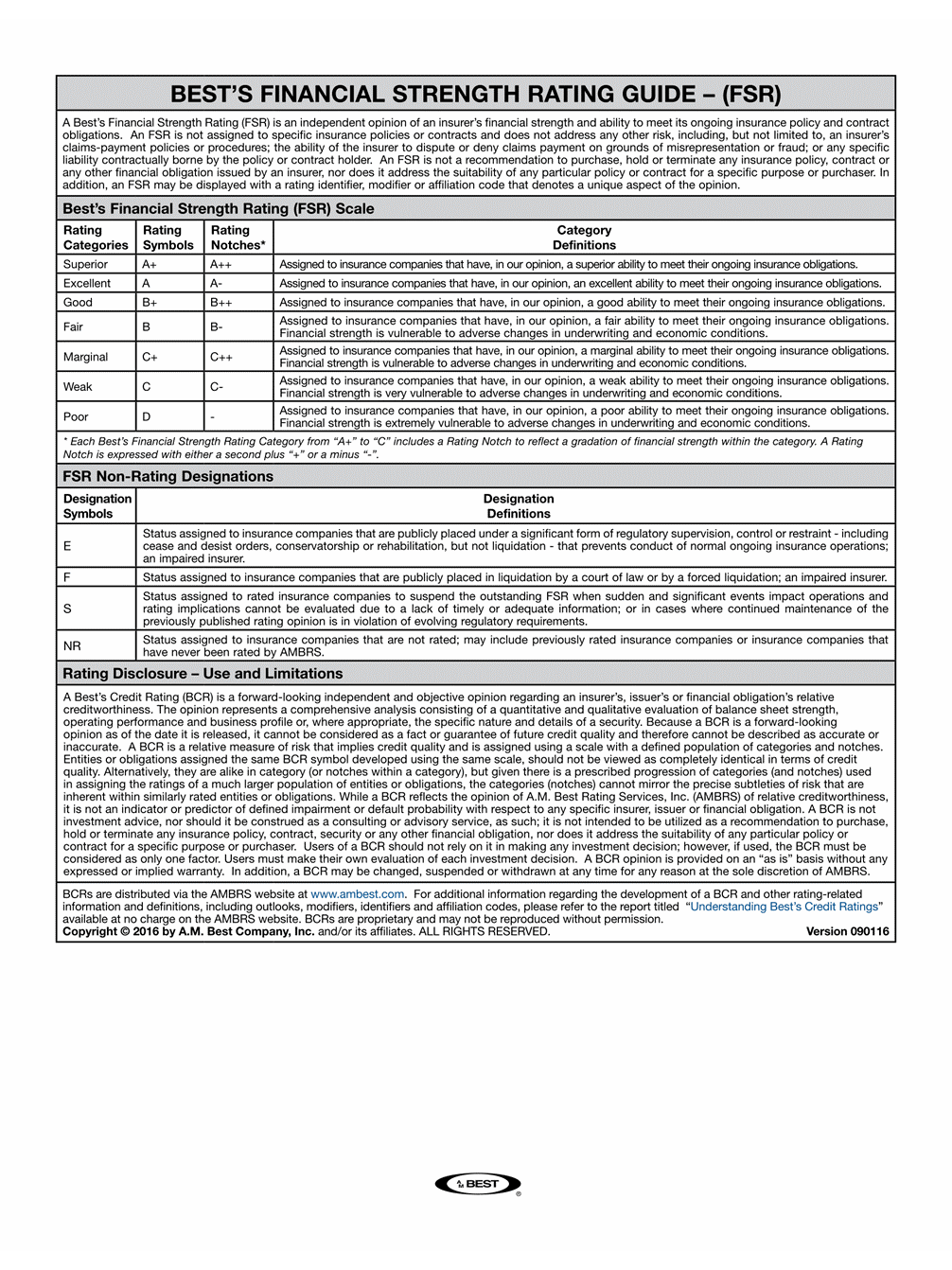

A Best’s Financial Strength Rating opinion addresses the relative ability of an insurer to meet its ongoing insurance obligations. It is not a warranty of a company’s financial strength and ability to meet its obligations to policyholders. View the A.M. Best Important Notice: Best’s Credit Ratings for a disclaimer notice and complete details at http://www.ambest.com/ratings/notice.

Best’s Credit Ratings are under continuous review and subject to change and/or affirmation. For the latest Best’s Credit Ratings and Best Credit Reports (which include Best Ratings), visit the A.M. Best website at http://www.ambest.com. See Guide to Best’s Credit Ratings for explanation of use and charges. Copies of the Best’s Insurance Reports for carriers listed above are also available upon request of your Gallagher representative.

Best’s Credit Ratings reproduced herein appear under license from A.M. Best and do not constitute, either expressly or impliedly, an endorsement of (Licensee’s publication or service) or its recommendations, formulas, criteria or comparisons to any other ratings, rating scales or rating organizations which are published or referenced herein. A.M. Best is not responsible for transcription errors made in presenting Best’s Credit Ratings. Best’s Credit Ratings are proprietary and may not be reproduced or distributed without the express written permission of A.M. Best Company.

Gallagher companies use A.M. Best Company’s rating services to evaluate the financial condition of insurers whose policies we propose to deliver. Gallagher companies make no representations and warranties concerning the solvency of any carrier, nor does it make any representation or warranty concerning the rating of the carrier which may change.

Proposal Disclosures

The following disclosures are hereby made a part of this proposal. Please review these disclosures prior to signing the Client Authorization to Bind or e-mail confirmation.

This proposal of coverage is intended to facilitate your understanding of the insurance program we have arranged on your behalf. It is not intended to replace or supersede your insurance policies.

|

Proposal Disclaimer |

IMPORTANT: The proposal, and any executive summaries included with or supplementing the proposal outlines certain terms and conditions of the insurance proposed by the insurers, based on the information provided by your company. It does not include all the terms, coverages, exclusions, limitations and/or conditions of the actual policy contract language. The insurance policies themselves must be read for those details. Policy forms for your reference will be made available upon request. We will not be operating in a fiduciary capacity, but only as your broker, obtaining a variety of coverage terms and conditions to protect the risks of your enterprise. We will seek to bind those coverages based upon your authorization; however, we can make no warranties in respect to policy limits or coverage considerations of the carrier. Actual coverage is determined by policy language, so read all policies carefully. Contact us with questions on these or any other issues of concern. |

|

Compensation Disclosure |

One of the core values highlighted in The Gallagher Way states, “We are an Open Society,” and our open society extends to the compensation Gallagher receives. In general, Gallagher may be compensated as follows:

If you have specific questions about the compensation received by Gallagher and its affiliates in relation to your insurance placements, please contact your Gallagher representative for more details. In the event you wish to register a formal complaint regarding compensation Gallagher receives from insurers or third parties, please contact Gallagher via e-mail at Compensation_Complaints@ajg.com or by regular mail at: AJG Chief Compliance Officer |

|

TRIA/TRIPRA Disclaimer |

If this proposal contains options to purchase TRIA/TRIPRA coverage, the proposed TRIA/TRIPRA program may not cover all terrorism losses. While the amendments to TRIA eliminated the distinction between foreign and domestic acts of terrorism, a number of lines of coverage excluded under the amendments passed in 2005 remain excluded including commercial automobile, burglary and theft insurance; surety insurance, farm owners multiple perils and professional liability (although directors and officers liability is specifically included). If such excluded coverages are required, we recommend that you consider purchasing a separate terrorism policy. Please note that a separate terrorism policy for these excluded coverages may be necessary to satisfy loan covenants or other contractual obligations. TRIPRA includes a $100 billion cap on insurers' aggregate liability. The TRIPRA program increases the amount needed in total losses by $20 million each calendar year before the TRIPRA program responds from the 2015 trigger of $100 million to $200 million by the year 2020. TRIPRA is set to expire on December 31, 2020. There is no certainty of extension, thus the coverage provided by your insurers may or may not extend beyond December 31, 2020. In the event you have loan covenants or other contractual obligations requiring that TRIA/TRIPRA be maintained throughout the duration of your policy period, we recommend that a separate "Stand Alone" terrorism policy be purchased to satisfy those obligations. |

|

Actuarial Disclaimer |

The information contained in this proposal is based on the historical loss experience and exposures provided to Arthur J. Gallagher Risk Management Services, LLC (License Nos. IL 100292093 / CA 0D69293). This proposal is not an actuarial study. Should you wish to have this proposal reviewed by an independent actuary, we will be pleased to provide you with a listing of actuaries for your use. |

|

CA Domicile Disclaimer |

This proposal of insurance features insurance policies which contain cancellation provisions and/or cancellation penalties/fees which refund premium other than on a pro-rata basis. The insurance carrier's assessment of such cancellation fees are detailed in this proposal for any line of coverage where the proposed insurer is applying such fees. |

|

Premium Note |

Premiums for the above policies are due and payable as billed, in full or as insurance company installments. Premiums may be financed, subject to acceptance by an approved finance company. Note: Following acceptance, completion (and signature) of a premium finance agreement with the specified down payment is required. |

|

Scope of Responsibility |

Gallagher is responsible for the placement of the following line(s) of coverage:

It is understood that any other type of exposure/coverage is either self-insured or placed by another brokerage firm other than Gallagher. If you need help in placing other lines of coverage or covering other types of exposures, please contact your Gallagher representative. |

|

Confidentiality Statement |

We consider as confidential any information presented by Arthur J. Gallagher Risk Management Services, LLC (License Nos. IL 100292093 / CA 0D69293) in our written response to your “request for proposal,” as well as subsequent verbal and written communications between our organizations. We ask that other brokers not have access to our material and that information presented in this proposal be shared only with those who have a need to know within your company. We make our commitment to you that information already received from you, and additional to follow, will be treated with the same high level of respect and confidentiality. |